A Decade of Community Rounds

How Wefunder has raised $20 million from its customers since 2012

- Since its founding in 2012, Wefunder has raised nearly $20 million through Community Rounds.

- In fact, even as it evolved from a scrappy civics project for America to the largest startup investing platform in the world, Wefunder has only raised money from its community.

- Today, Wefunder helps thousands of startups across the country get funded by their most passionate customers, fans, and community members.

- But what many don’t know is that Wefunder literally had to get Congress to change the law ten years ago to make their mission possible.

- In this special feature, we hear from Wefunder Founder & CEO Nick Tommarello, who takes us through the personal story of his entrepreneurial origins to his reflections on running Wefunder over the last ten years and his visions for what’s next.

A DECADE OF COMMUNITY ROUNDS

We’ll have Nick, Founder & CEO at Wefunder, take it from here →

Where it all started

I grew up in a rural county in upstate New York. My dad was an entrepreneur, and he was always starting businesses. Sometimes they were successful, but four times, to be exact, he went bankrupt with nothing but $20,000 of credit card debt to his name.

Because of that, I was never your typical student. I had to work 50 hours a week. Throughout high school, I worked as a dishwasher, busboy, omelet maker, construction worker, barista, supermarket express line cashier, waiter, food runner, and, of course, my dad’s helping hand every time he started another business.

My dad didn’t do tech companies. His businesses were in construction, real estate, and restaurants. One summer, we spent every hour of two and a half months building a whole nightclub from the ground up.

Building businesses with my dad was the impetus for who I am now. To me, he was living proof that you could create your own rules in the world—that if you really wanted to do something, the world could adapt around you.

As early as I can remember, I knew I would never be a cog in someone else’s machine or settle for a normal job. I would start my own company—I just didn’t know what that would look like at the time.

As early as I can remember, I knew I would never be a cog in someone else’s machine or settle for a normal job. I would start my own company—I just didn’t know what that would look like at the time.

Nick TommarelloFounder & CEO at Wefunder

“Specialist @ Failing Fast”

After graduating business school, I spent two years developing nearly a dozen iPhone apps. All of them focused on finding non-creepy ways to help people make new friends in the real world. All of them failed. But in the process, I met my first investors, who changed my life.

Bill Warner sat next to me in the coworking space where I worked back then. We became friends, and he wrote me my first $25,000 check to build what would become Wefunder. He had already made his money in life, and helping founders was his way of giving back and getting fulfillment.

That was the first of many times that I would be intrigued with the relationship between the investor and the founder—especially an early-stage founder who doesn't yet know what they're capable of.

I wanted to do the same thing for others. Not with $25,000, because I didn’t have that, but at least with a couple hundred bucks. And I had an instinct that it wasn’t just me. Other ordinary people would probably also like to invest small sums of money in very risky things, for reasons beyond just making a return.

That was the first of many times that I would be intrigued with the relationship between the investor and the founder—especially an early-stage founder who doesn't yet know what they're capable of.

Nick TommarelloFounder & CEO at Wefunder

Changing the law for unaccredited investors

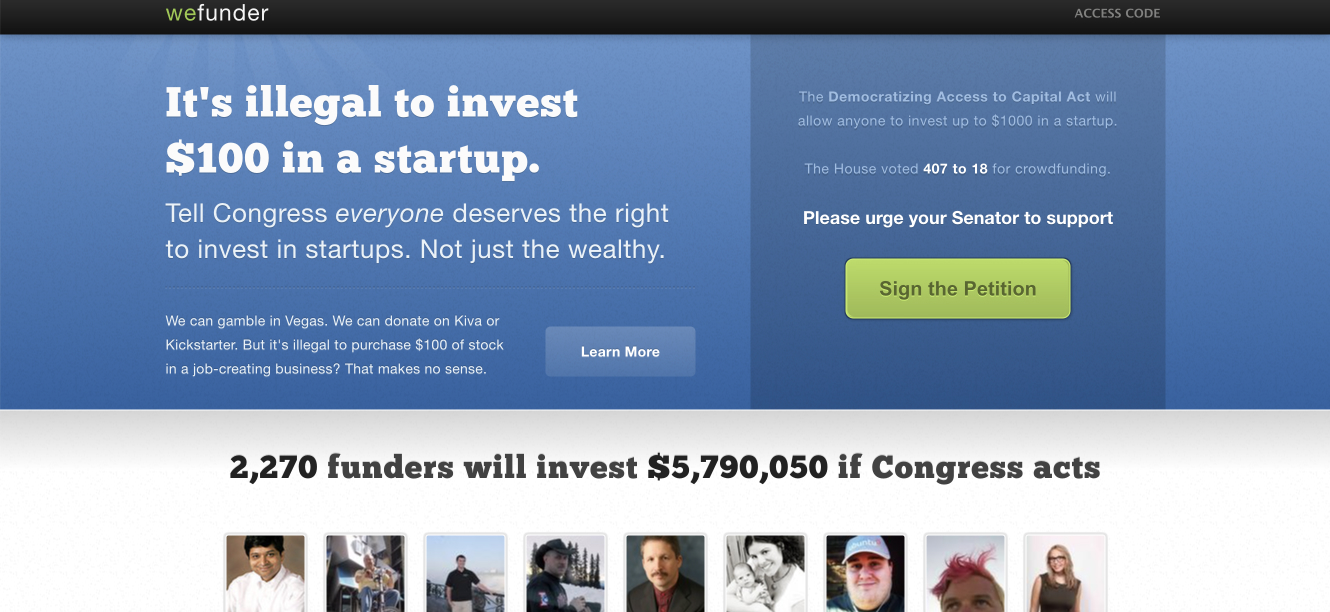

From 1933 to 2016, it was illegal to make an investment in a private company unless you were an accredited investor (i.e. rich). However, by 2012, there was growing bipartisan support to allow everyday people to invest in small businesses and therefore generate more jobs. A law reform had passed through the House already, but it was a non-starter in the Senate.

Newly passionate about this issue, I was thinking, “How do I get this unstuck in the Senate?” With my friends Greg and Mike, who would become my cofounders at Wefunder, we launched a website to build more momentum around the law that was being debated.

The original wefunder.com explained why everyday people should be allowed to invest in startups, and it ended with a petition. The critical thing I did at the time was to require visitors not just to sign their names on the petition, but also the amount of money they would invest if they were allowed to.

Within an hour of launching the site, the petition reached over $5 million from over 2000 people. The message was clear: There are actually people who want to invest in small businesses and help create jobs, if only Congress would allow them to.

It didn’t take long for the press to write about our site. Two days later, our petition was put in front of Congress.

A week later, Greg, Mike, and I got flown to DC. In a day, we met three different senators, a Congressman, the President’s office, and their staff. By the end of our back-to-back meetings, we watched President Obama sign the JOBS Act into place at the Rose Garden.

We just had one problem: it would take the SEC 4 years to make the new laws a reality, and another 4 years on top of that to truly make Community Rounds appealing for top-tier founders.

Within an hour of launching the site, the petition reached over $5 million from over 2000 people.

Nick TommarelloFounder & CEO at Wefunder

Rich People Crowdfunding: 2012–2016

The joke at Wefunder is that we always thought the rule change was just 9 months away. From 2012 until 2016, we did Rich People Crowdfunding, aka crowdfunding-but-still-for-accredited-investors-only.

Personally, I didn’t get much fulfillment from it. That business looked like this: begging founders who don’t need the money to get in on their hot rounds, and then helping wealthy people get wealthier by investing in those companies. It was soul-sucking, honestly.

Still, we kept unaccredited investors top of mind as we built the product, knowing that the laws would change in their favor one day. For instance, we set the minimum investment amount to $100—that made no sense for any of our accredited investor users at the time.

We were also constantly exposed to high-caliber founders with great companies. Subconsciously, that affected how we thought. One of Wefunder’s core strengths is that we intuitively understand how high-caliber founders think.

Fortunately, the laws we’d lobbied for became a reality on May 16, 2016. With that, our era of Rich People Crowdfunding came to a close.

As of April 2022, Wefunder has helped 1900+ founders raise over $250 million. Over 500,000 people have invested on Wefunder, with a median investment of $250.

Nick TommarelloFounder & CEO at Wefunder

Regulation Crowdfunding: 2016–Today

Finally, it was official: anyone could now invest a minimum of $100 into any pre-IPO company.

Our team of eight had set up 25 companies to raise money from unaccredited investors on Wefunder. After months of preparation, we planned for them to launch simultaneously without a hitch.

That morning, we had a massive spike in traffic. We were suddenly tasked with a challenge we hadn’t expected: making sure the website wouldn’t go down.

Unfortunately, we had all gone three days with no sleep, and as my cofounder Greg was deploying some code, he literally passed out.

I then had to make the call that I thought it would be better for the company if Greg took a half-hour nap, even though the website was getting very unstable. At the end of 30 minutes, I went, “Hey, Greg—I have this guy in Germany on the phone who thinks he can solve our problems by changing all of our DNS settings. Is that a good idea?” He woke up right away and fixed the problem.

By the end of that day, we had helped 25 companies raise millions of dollars cumulatively from unaccredited investors, who had invested in pre-IPO startups for the first time in history.

For founders, pulling off a Community Round is one of the strongest indicators that you’ve built something successful. It’s the highest validation from the market.

Nick TommarelloFounder & CEO at Wefunder

Bonus: Even more legal reforms

In March 2021, another set of legal reforms made it even more attractive for top-tier founders to raise Community Rounds.

Now, Community Round investors occupy a single line on the cap table, thanks to what’s called a special purpose vehicle (SPV). Founders choose just one lead investor to have voting rights for the SPV.

The maximum you can raise from unaccredited investors is $5M a year, when it used to be $1.07M.

Where does that bring us now?

As of July 2022, Wefunder has helped 2000+ founders raise over $500 million. Over 500,000 people have invested on Wefunder, with a median investment of $250. And Community Rounds have proven themselves to work great in conjunction with VC funding too.

Companies raising Community Rounds range from a16z-backed startups like Mercury, Levels, and Replit to small businesses across the country: a fruit and bison bar company on the Pine Ridge Reservation in South Dakota; a neighborhood restoration in Chicago’s South Side; an artificial pancreas for people with type 1 diabetes; a literal flying car company; and many, many more.

For founders, pulling off a Community Round is one of the strongest indicators that you’ve built something successful. It’s the highest validation from the market.

For investors, backing a Community Round helps a founder take their shot. There’s a power to that that can never be underestimated.

I’ve never done a traditional venture capital funding round. I've simply let my users invest in me, and that’s allowed us to build this whole company.

Nick TommarelloFounder & CEO at Wefunder

Why we decided to raise a Community Round

We eat our own dog food, as they say.

From 2012 to 2022, Wefunder has only raised money through Community Rounds. I’ve never done a traditional venture capital funding round. I've simply let my users invest in me, and that’s allowed us to build this whole company.

In our first Community Round in 2012, we raised $500,000 from accredited investors, because that was the legal maximum. In our most recent 2021 Community Round, we raised the new legal maximum of $5 million from unaccredited investors.

In total, over the last 10 years, thousands of users have helped us raise nearly $20 million to get the company to where it is today.

If you want to see for yourself, check out our Community Round page. We’ve been opening it up for investments roughly once or twice a year for the last decade: wefunder.com/wefunder

To read more about Wefunder, you can check out our Public Benefit Charter, our Impact Report, and the companies raising Community Rounds with us today.

Thank you for being on this journey with us.

Why did people invest?

Summary

Wefunder raised $20 million from 6,000+ investors over a decade of Community Rounds.

Snapshot of Wefunder' Community Round (source wefunder.com/wefunder)

The Raise

- Raised $20M from 6000+ investors

- Raising Community Rounds 1-2 times a year since 2012

- First Community Round in 2012 raised $500,000.

- Latest Community Round in 2021 raised $8,404,355.

- As of Q2 2022, helping 500+ startups raise Community Rounds concurrently