Breaking a Wefunder Record

How Mercury raised $5M in 90 minutes during their Series B Community Round

- Within 90 minutes...

- Mercury raised $5 million from 2,450 investors

- 75% of them were already Mercury customers

- In the next 9 days, the round reached $23M in reservations

BREAKING A WEFUNDER RECORD!

We’ll have Mercury Founder & CEO Immad Akhund take it from here →

What is Mercury?

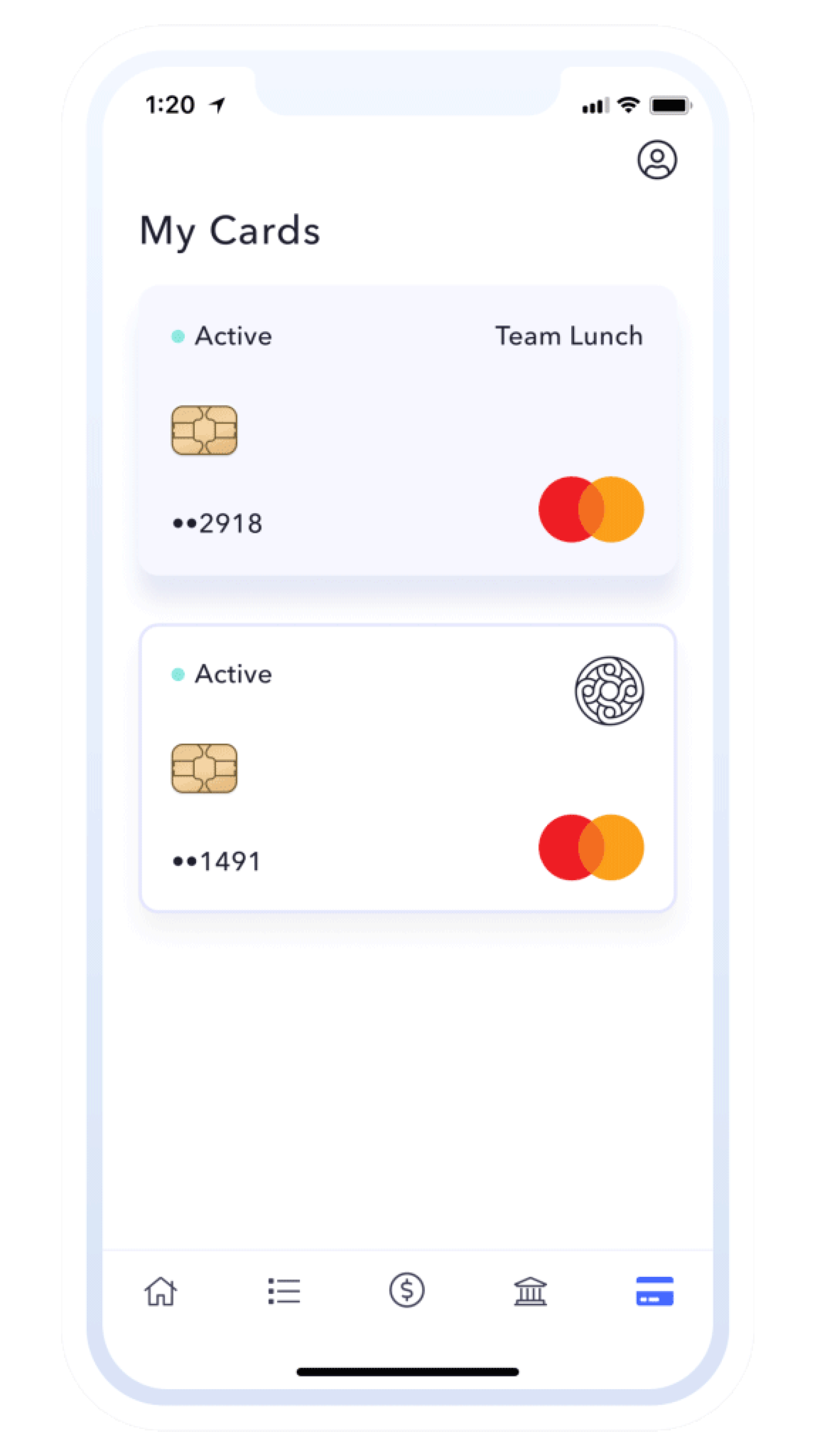

Mercury is an online-first banking platform for startups and ecommerce companies. As a company founder, you can go to Mercury.com to open a business bank account, get virtual and physical debit cards, and run your business.

I founded Mercury because I’d been so frustrated with the banking experience while running my first startup. As any founder who’s used a bank would know, traditional business banking is stagnant and broken.

After raising our seed round at the end of 2017 from Andreessen Horowitz, we built our basic product, launched in April 2019, and raised a Series A from CRV. A year and a half later in July 2021, we raised a $120 million Series B led by Coatue—and we allocated $5 million of the Series B to a Community Round with Wefunder.

With Community Rounds, we give ownership to the community—so that when we’re successful, our community is successful.

Immad AkhundFounder & CEO of Mercury

Why we raised a Community Round

It’s not that we needed the money—our community round was oversubscribed, and we'd already raised $120 million. The main factor for me is that our customers are important to us, and it made sense for them to be owners in Mercury.

I’ve always liked having a lot of investors at Mercury, especially because our investors and customers are entrepreneurs, too. I had 60 investors in my seed round, while most seed rounds have fewer than 10 investors. This community round, we were able to add 2,500 additional investors, which is incredible if you think about it!

The legal landscape made it possible. People seem to have a feeling like “four years ago it was possible, but no one was doing it.” Actually, what’s changed in March 2021 with Regulation Crowdfunding (or Reg CF) is that you can aggregate the investments in a special purpose vehicle (SPV), and you can raise up to $5 million (previously $1.07 million). That regulation alone has changed community rounds from a relatively niche thing to something that any Series A or Series B company can do—and perhaps should do.

We’ve always had people asking us if they could invest, and we had thousands of customers by the time we raised. Opening our Series B to the community made sense. It was cool to actually have our customers be part of the news rather than just watch it happen from the sidelines.

I don’t recommend a community round for every company, but I do think that once you have a strong community and thousands of members in it, then a Community Round is a meaningful way to involve them in your company’s future.

Once you have a strong community and thousands of members in it, then a Community Round is a meaningful way to involve them in your company’s future.

Immad AkhundFounder & CEO of Mercury

For Mercury, community simply means doing a good job with the entrepreneurs we serve.

Personally, it’s unnatural for me to think, “I’m trying to do community.” I think of it more as, “I’m trying to be helpful,” and one of Mercury’s company values is to “Be Super Helpful.” We try to do genuinely useful things for entrepreneurs, and community arises organically.

On a personal level, I try to help entrepreneurs as much as possible by tweeting often, giving advice, and being an active seed-stage investor. At Mercury, we create educational content for entrepreneurs, build interconnective tissue for entrepreneurs through programs and events, and involve our investors to participate in our community, even if they're not active Mercury users.

And now, with Community Rounds, we give ownership to the community—so that when we’re successful, our community is successful.

Why did people invest?

Second-Order Effects with Mercury Head of BizOps Lucia Qian →

We raised company morale...

Raising a Series B feels abstract for the team. Most people in the company aren’t involved in any way; Immad goes out and talks to a bunch of investors, and then all of a sudden the team gets a message saying, “Hey, we just raised all this money”—then we go, “Oh, exciting!”

With Wefunder, what’s cool is that the page is public and you get to see the numbers tick up. Our team was constantly refreshing the page to see the progress and the comments. Those who interact infrequently with customers got a chance to feel that energy from a community that was very excited about us. We had also opened up the round for employees to invest, because a few employees had expressed interest. The entire company was touched in some way, much more so than a typical raise.

...and got a fresh set of eyes for product feedback.

Because I also work on the product side, I’m always trying to figure out what we should build next; what are the pain points people have? After the raise, I decided to go straight to the top of this list of investor-customers for feedback. These are some of the busiest people—the co-founders — and the response rates were phenomenal.

I’m still having conversations with many of them now for another big feature we’re working on. It’s been so helpful to have access to that feedback quickly, and with people who are extremely willing to make introductions, offer their time on 1:1 calls, or put me in touch with the contacts at their company who have more context.

The entire company was touched in some way, much more so than a typical raise.

Lucia QianBusiness Operations at Mercury

Summary

Mercury raised $4,914,037 from 2,453 investors during their first Community Round.

Snapshot of Mercury's Community Round (source wefunder.com/mercury)

Community Round Stats

- $5M in the first 90 minutes

- $23M in the resulting 9 days

- 75% investors were customers

- $2,000 average investment

- 19% of investments were $500 or less

Opened Community Round during

- $120M Series B from Coatue, CRV, Andreessen Horowitz, and angels

Post Community Round

- 10% of investors became customers

- 956 praises from their community