Democratizing Real Estate Investing

How Arrived oversubscribed their round by 20x, and welcomed 3,018 new owners from their community

- For years, Arrived received requests from their clients to invest in their company…

- After their Series A, they listened.

- They secured over $10M in reservations for their $500k community allocation…

- ultimately closing $2,329,410 from 3,018 investors.

We’ll have Arrived Co-Founder & COO Alejandro Chouza take it from here →

What is Arrived & why did you start it?

Ryan, Kenny, and myself started Arrived back in 2019.

The impetus for founding the company was, finding a way to make it more accessible for anybody to get property ownership in this country. The three of us moved around a lot when we were younger and we never really had the opportunity to start investing in real estate. We always felt that put us behind in terms of our ability to build wealth, so we thought about what would be the easiest way to help people in our position start putting at least something into real estate?

We came up with this idea of a platform where anybody, whether you're accredited or not, could invest starting at a hundred dollars. We modeled that experience off what would happen if Amazon and Zillow had a baby. You have these property pages with images where people could get to know a house, but at the same time, have a quick add to cart button that lets them check out in under four minutes.

Based on that desired product experience, we built it. From the beginning, we were very thankful that we saw a lot of interest from our clients. We were basically the first company to fractionalize individual rental homes and take them through the SEC process to put them up for public sale.

The people just got it instantly and we started funding homes from day one. It's very similar to stock investing where you have blue chips, high growth companies. etc. Real estate has very similar dynamics across asset classes and right now, we only play in a small sliver. Our vision over the next year is to responsibly grow into those other asset classes to offer wide availability of products that can do well in all cycles, whether it's high interest rates, low interest rates, downturns, upturns and everything in between.

We always felt that not having access to real estate put us behind in our ability to build wealth, so we thought about how we could make it easy for people in our position to start investing in real estate.

Alejandro ChouzaCOO Arrived

Why we decided to raise a Community Round?

A lot of our early clients who invested in homes wrote to us and said “Hey, we would love to invest in your company.” We loved this idea and toyed with it internally for a long time. We thought it would be great to bring our clients onboard and make them co-owners of this company.

But, a community round never felt like a priority when you're juggling 20 priorities. When you're running a startup, the biggest decisions you make are, what do you spend your time on? And what do you not do? For the longest time, the Community Round was kind of in that ‘can't do’ bucket. We really wanted to do it, but it would be distracting.

As we started fundraising from the venture route, things were relatively easy. We closed a $10 million Seed and then, we did our Series A, which was $25 million. We were always oversubscribed in our funding, and it was tricky getting people an allocation. We could never find the right moment to open this Community Round.

We had known about Wefunder for a while. We’re been big fans because I think we share a lot of the same company DNA. As we got to know the team, it just became a no brainer to partner. We learned that there's a way to do this with low lift with a great partner that helps us.

So, although we had years of runway and ample funding, in 2023 we announced that we're going to do an extension to our Series A and open a small allocation to clients to invest in Arrived itself.

For the longest time, the Community Round was kind of in that "can't do" bucket. We really wanted to do it, but it would be distracting. We learned that there's a way to do this with low lift with a great partner that helps us.

Alejandro ChouzaCOO Arrived

How the round went

We initially set out to raise $500,000. We spent about a week or two just putting together the initial pitch being very transparent about our business. We wanted to make sure that we were being very honest with our clients about the opportunity, but also the challenges.

When we announced it, we emailed our community of users, which was in the hundreds of thousands of folks and very quickly we saw a lot of attention. We had over $10M in reservations and decided early on that we would have to increase our original allocation to maximize the number of investors who could participate.

Again, we had heard a lot of folks say that they wanted to invest in Arrived over the years. But when you see people start to actually put a number next to that, we were blown away!

We started getting emails from those folks that had previously requested to invest saying “I've been asking you about a community around for a while. Thank you for listening to me.” It was very nice to see that go from words to action. So yeah, we were thrilled.

We were very happy with with Wefunder partnership because you all allowed us to take that step in a way that was relatively easy for us.

Again, we had heard a lot of folks say that they wanted to invest in Arrived over the years. But when you see people start to actually put a number next to that, we were blown away!

Alejandro ChouzaCOO Arrived

How did you build such a passionate community for Arrived?

We started as a small team of three founders; bootstrapping. We were very hands-on in in our client interactions. With the first folks that we pitched to invest in these properties, we were getting on five hours of zoom calls every day with clients.

Something that we've always wanted to have in our DNA is staying very close to our clients to understand, how do we solve a problem for you? Especially because Arrived is a new product, we had to design our whole company and product around what we were hearing, so we always had that very close relationship. For the longest time, we had a 1-800 number on our website that would go straight to us three founders.

Now that I think about it, that’s a very unscalable way to run a business. But, we knew that that time invested in being close to our client base would be ultimately great in the long term. So as we grew out the team and scaled our operations, we very much kept that hands-on mentality, not only for ourselves, but for our whole team and I think our clients have seen that and really appreciate that. There is a certain trust and open line of communication between us and that has encouraged clients to feel more like a community.

We also have a Reddit group that's very actively involved and all three cofounders are posting in that regularly, including on Saturday nights. When somebody says, “Hey, I've got an idea for this product development” we really take that seriously, take a call to understand the details, and try to turn that around as quickly as possible. That bleeds into the Community Round and contributes to feeling like we’re on the same team.

It's the unscalable things that end up giving you a lot of value. A lot of times people think you have to scale for billion dollar growth and all that. And yes, that’s important, but you also have to do a lot of things that just on paper don't make sense. But the increments really add up.

When somebody says, “Hey, I've got an idea for this product development” we really take that seriously, take a call to understand the details, and try to turn that around as quickly as possible. That bleeds into the Community Round and contributes to feeling like we’re on the same team.

Alejandro ChouzaCOO Arrived

Why did people invest?

The impact of our Community Round

Creating our community and helping us build stronger and better has been one the best benefits post-raise, in addition, of course, to the funding and all the other benefits. The most memorable thing that we've seen is how investors are talking about Arrived. They’ve changed from “you” as a company to “we” as a company. We love that investors feel that sense of joint community, since that's what we wanted to accomplish when we set out to do this raise.

About 65% of our Community Round investors were also active Arrived users. Following the Community Round, these investors have invested, on average, 3.9x more on the Arrived platform compared to those who did not participate.

Now, when we send out quarterly updates, we're getting a lot of feedback now that many of these investors are co-owners in the company who have skin in the game. Whether it's like, “Hey, I saw this bug in the mobile app”, or “I really would love if you had like CSV export for my portfolio”, it's really created this awesome focus group that sends us great ideas that we love having. We really consider our investors as part of the Arrived team.

In one recent investor update, we were talking about our app and some of the improvements we've made. As we were informing investors of some of the product work on the app, some investors responded saying "we'd love to go in and put app store reviews" and really help you evangelize to improve your rating. We thought that was a great idea! So, in our next update, we causally said, "Hey, for those of you who have invested in Arrived and are happy with your investment, here's a link to go in an share your experience, whether good or bad" and a lot of those investors went in to review the app.

What has been the feedback from Arrived's Team and other investors?

We've gotten a lot of feedback both internally from our team, but also existing and potential future investors. Having clients that like our products so much that they're willing to invest in the company has given a lot of confidence and reinforced that what we're doing is resonating with a lot of people.

An investment is a different level of belief and excitement. Instead of tracking NPS as like, "would you recommend this product to your friend", our bar is, "Hey, do you like this product enough that you would invest in the company?" It’s been a very exciting thing to see all the thousands of people be excited about investing. And I think our general community, whether it's our previous equity investors or our team really feels the excitement as well!

An investment is a different level of belief and excitement. Instead of tracking NPS as like, “would you recommend this product to your friend”, our bar is, “Hey, do you like this product enough that you would invest in the company?”

Alejandro ChouzaCOO Arrived

Summary

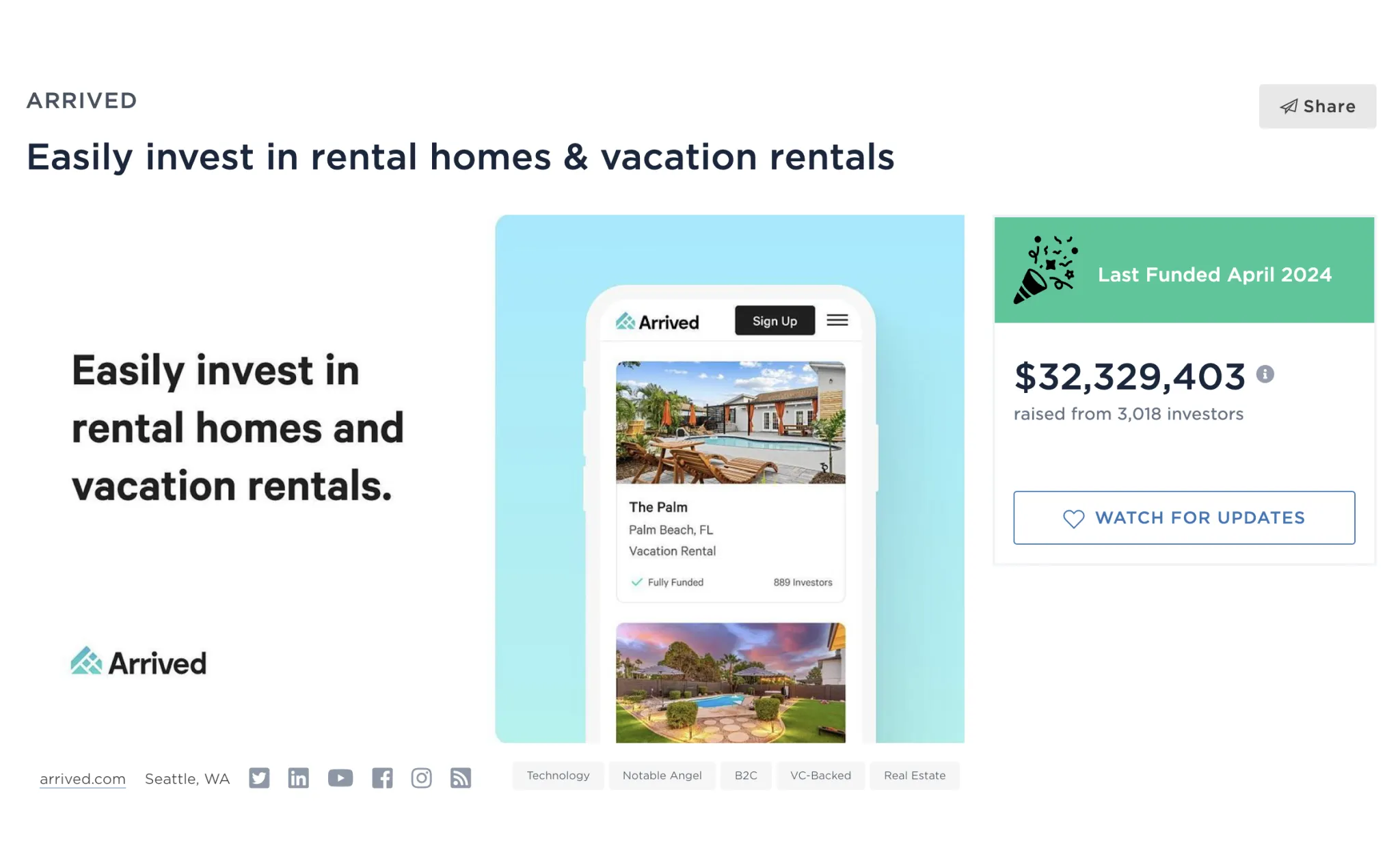

Arrived raised $2,329,410 from 3,018 investors during their Community Round.

Snapshot of Arrived's Community Round (source wefunder.com/arrived)

The Raise

- Arrived received over $10M in total reservations before formally launching their community round

- ~65% of Arrived’s 3,018 investors on Wefunder were already active Arrived investors

- Arrived investors who invested in the community round invest 3.9x more on Arrived than those who did not invest in the community round.

- Median check size = $500